Endow Iowa State Tax Credit

Endowed vs. Non-Endowed Funds

Endowed funds are intended to be preserved forever, with a portion of the earnings available for spending. It is a permanent savings account that grows through investment and financial contributions from donors. Distributions from the fund are capped at 5% per year and are used to provide stability and long-term support to organizations, creating an even bigger impact in the future!

Non-endowed funds are invested for growth in the same way as an endowed fund, but funds are not permanent, and they are immediately available for distribution.

Endow Iowa State Tax Credit

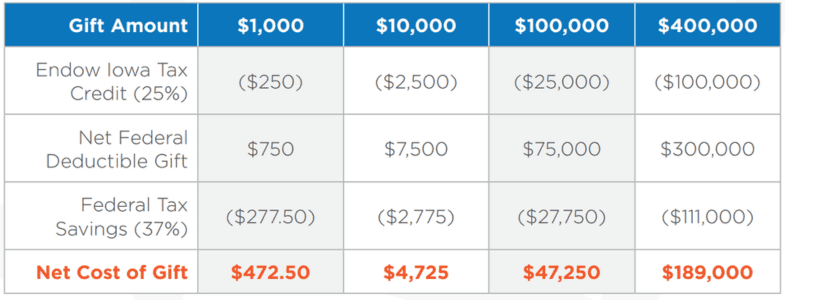

When you make a gift to one of our permanently endowed funds, it will cost you far less thanks to Iowa’s innovative Endow Iowa 25% State Tax Credit! As a nationally accredited community foundation, we have been proud to offer this program, which gives donors who give to a permanently endowed fund at a qualified community foundation an opportunity to receive a 25% state of Iowa tax credit for their gift.

The state of Iowa offers $6 million in Endow Iowa Tax Credits each year to promote giving to permanent endowments that benefit organizations and citizens in Iowa. This program is producing substantial and sustainable support to nonprofits in Iowa. You can take advantage of this opportunity by:

- Establishing an endowment fund to achieve your personal charitable goals

- Giving to one of our existing endowment funds

Tax credits are distributed on a first-come, first-served basis and donors are encouraged to give early each tax year to take advantage of this program.

A variety of gifts qualify for Endow Iowa Tax Credits including cash, retirement assets, appreciated stock, and real estate. No minimum gift amount is required to qualify for Endow Iowa Tax Credits and the maximum tax credit is $100,000 ($200,000 per couple).

When you give to one of our endowed funds, you are not only helping Waterloo today – you’re investing in the future of the city we love!

If you have questions or would like to learn more about this program, please contact us any time.